Building your dream home takes money. However, where and how you source your funds greatly affects your financial health. Here are some helpful tips.

Building your dream home is an exciting yet complex process, and one of the most important aspects is securing the necessary funds. That can be daunting, but with strategic planning, it’s possible to streamline the process and find the right financing solutions.

Whether building from scratch or improving upon an existing property, understanding your financing options will help you manage costs and stay on track. This article explores different financing avenues, including refinancing options, timelines, and budgeting tips to help you construct the home of your dreams.

The first step in financing your dream home is creating a comprehensive budget. A well-planned budget will guide your construction project and help you assess how much financing you’ll need. Here are the key elements to consider:

Once you clearly understand your projected costs, it’s time to explore financing options.

Financing a construction project differs from securing a traditional mortgage. Instead of borrowing a lump sum for an existing property, you’ll need to consider construction-specific loans, which allow for phased disbursements as the project progresses. Here are a few common options:

– Construction Loans: Construction loans are short-term loans specifically for building a home. They typically last 12 to 18 months, covering the construction period. Funds are released in stages, usually after each significant phase of construction is completed. Once your home is finished, you can either pay off the loan or convert it into a permanent mortgage.

– Construction-to-permanent Loans: This option combines the benefits of a construction loan and a mortgage. During the construction phase, you receive funds as needed. Once the project is complete, the loan transitions into a long-term mortgage. The main advantage of this type of loan is that you only need to go through the approval process once, avoiding the hassle of reapplying for a mortgage after construction.

– Owner-builder Loans: An owner-builder loan may be the right choice if you plan to serve as your own contractor. However, these loans require you to demonstrate significant experience or knowledge in construction, as lenders see these projects as higher risk. While potentially more cost-effective, they are more challenging to secure.

Refinancing existing loans is one strategic way to fund your dream home construction. For homeowners with student loan debt, specifically Parent PLUS loans, refinancing these loans can free up funds that can be redirected toward your construction project.

Refinancing replaces one or more active loans with a new one at more favorable terms—usually a lower interest rate or an extended repayment period. By refinancing your Parent PLUS loans with a provider like SoFi, you may secure better rates and terms. That lets you reduce your monthly payments, consolidate debt, and free up cash flow you can allocate toward your construction budget. You can explore this option further with Parent PLUS loan refinancing, which effectively optimizes your finances during home-building.

Building a home requires not only careful financial planning but also patience. Setting a realistic timeline is essential to keeping your project on track and within budget. Here’s a general outline of a typical home construction timeline:

Keeping your dream home construction within budget requires discipline and attention to detail. Here are some tips to avoid going over budget:

Financing your dream home construction is a multifaceted process that requires careful planning. Still, with the right strategy in place, it is entirely achievable. Whether you’re using construction loans, refinancing existing debts, or exploring a combination of options, there are numerous ways to make your vision a reality.

By planning your budget, securing financing that fits your needs, and sticking to your timeline, you’ll enjoy the home you’ve always dreamed of. Keep an eye on interest rates, consider refinancing when it makes sense, and remember that patience and careful management are key to bringing your dream home to life.

** In collaboration with SoFi.

Thank you for shopping through Home Bunch. For your shopping convenience, this post may contain AFFILIATE LINKS to retailers where you can purchase the products (or similar) featured. I make a small commission if you use these links to make your purchase, at no extra cost to you. Shopping through these links is an easy way to support my blog and I appreciate and I am super grateful for your support! I would be happy to assist you if you have any questions or are looking for something in particular. Feel free to contact me and always make sure to check dimensions before ordering. Happy shopping!

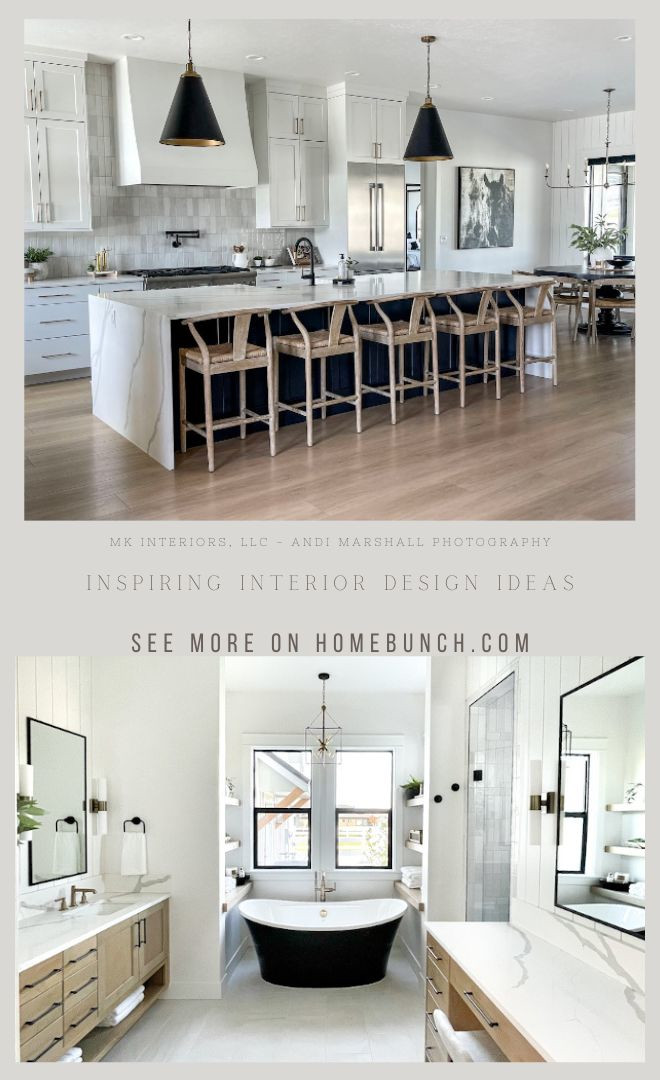

Coastal Inspired Home in Utah.

Coastal Inspired Home in Utah.

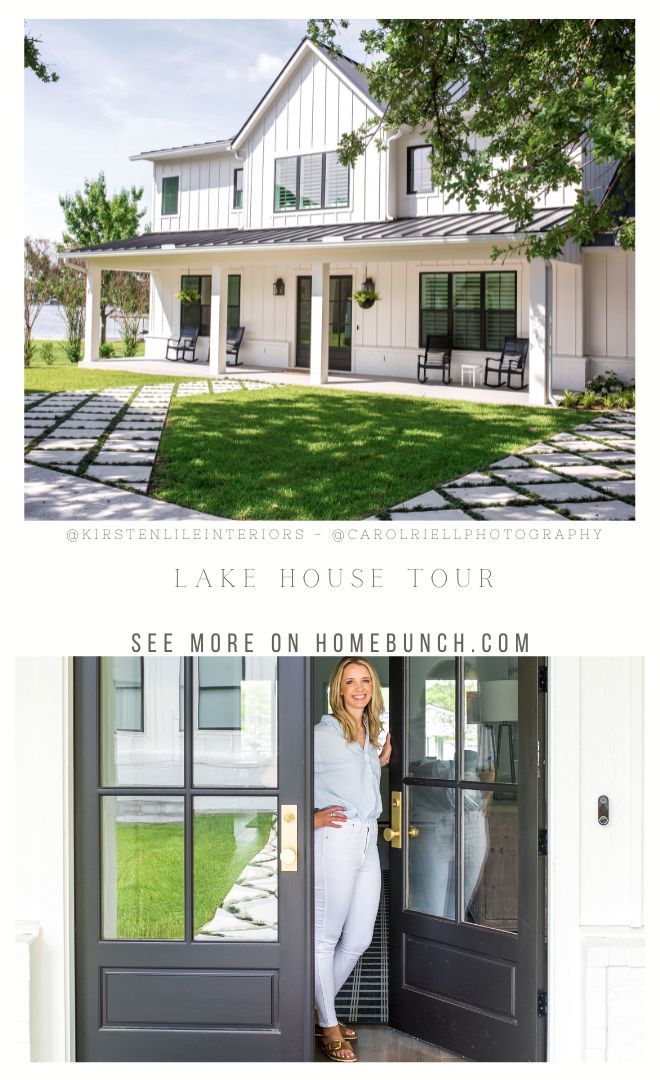

Texas Lake House Tour.

Texas Lake House Tour.

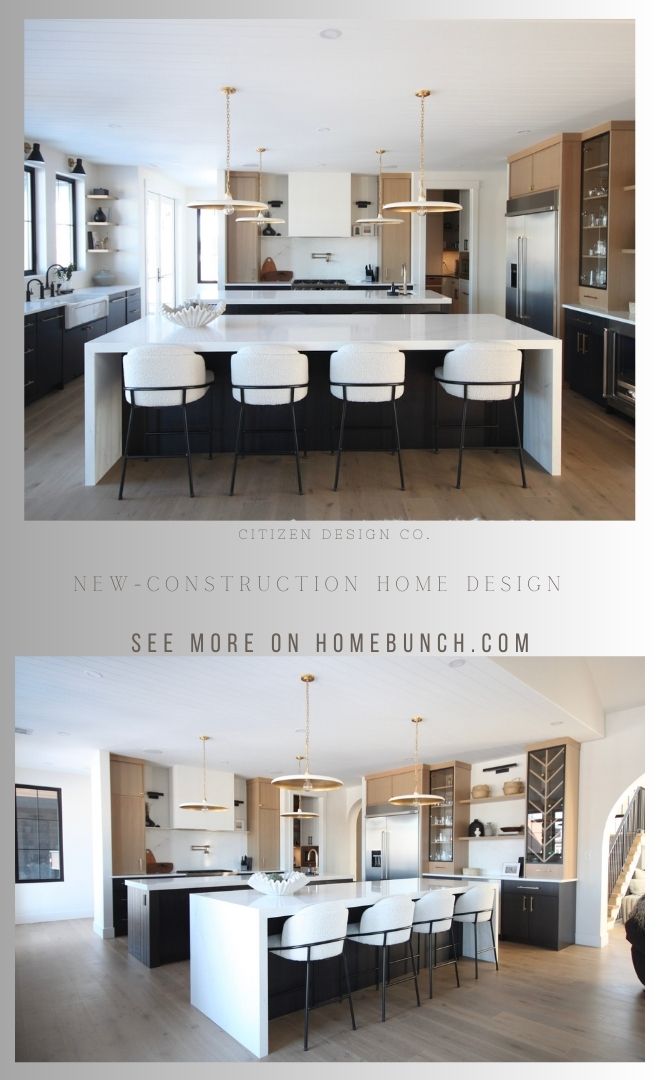

New Home in Naperville, Illinois.

New Home in Naperville, Illinois.

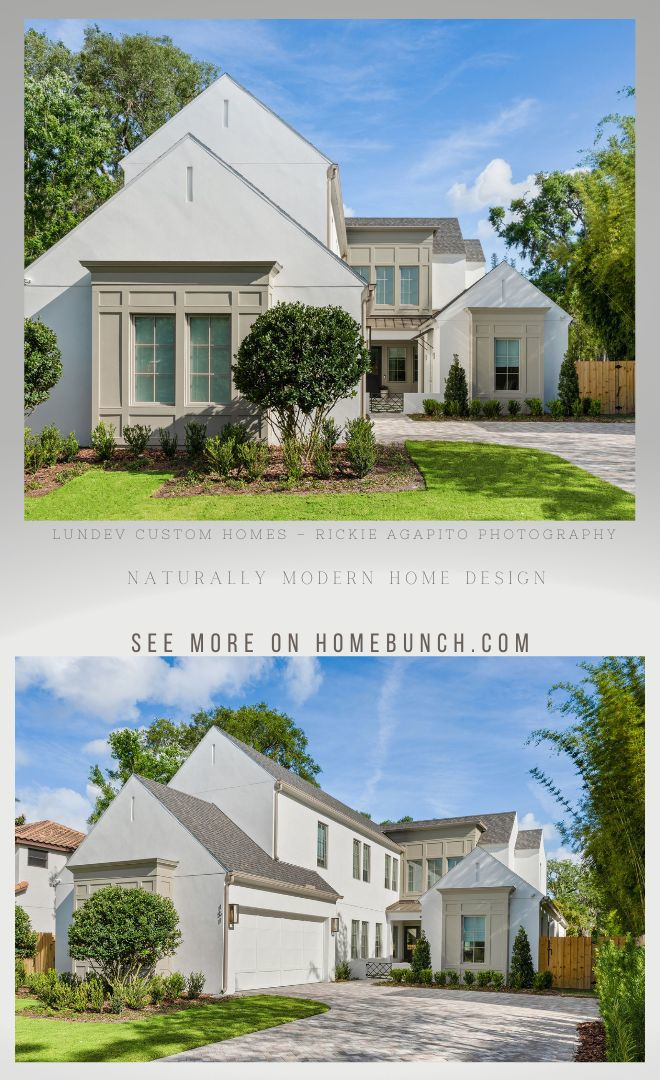

“Dear God,

If I am wrong, right me. If I am lost, guide me. If I start to give-up, keep me going.

Lead me in Light and Love”.

Have a wonderful day, my friends and we’ll talk again tomorrow.”

with Love,

Luciane from HomeBunch.com

No Comments! Be The First!